The potential export of NVIDIA’s B30A AI chip to China poses critical geopolitical and technological implications. This chip, a downgraded Blackwell model, could significantly narrow the US’s AI compute advantage. While some argue that allowing sales might curb China’s domestic chip efforts, restricting these exports ensures the US maintains global leadership in AI development and preserves strategic leverage over advanced computing capabilities.

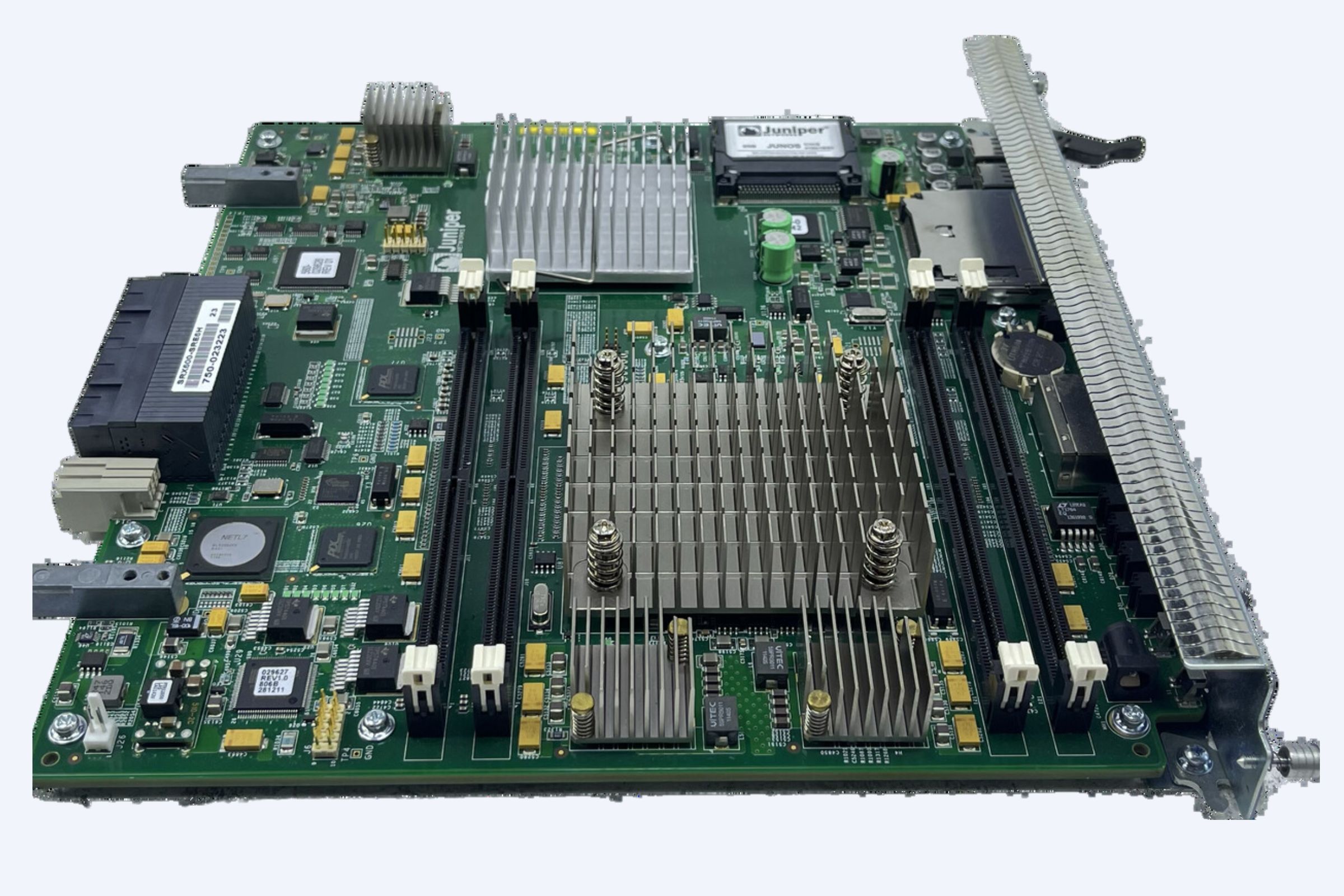

What Are the Specifications of the B30A Chip Compared to the B300?

The B30A is designed with one AI processor die and four HBM stacks, half the B300’s configuration. Despite the reduced hardware, it offers competitive performance for large-scale AI clusters due to its price-performance ratio. Networking multiple B30As can achieve processing capabilities comparable to B300-based systems, making it an attractive, cost-effective option for AI labs.

| Chip Model | Processor Dies | HBM Stacks | Relative Performance | Approx. Price |

|---|---|---|---|---|

| B300 | 2 | 8 | 100% | $53,000 |

| B30A | 1 | 4 | 50% | $22,500 |

WECENT highlights that the B30A’s integration into enterprise clusters could provide scalable solutions, leveraging reduced energy consumption and networking costs while maintaining strong AI performance.

Why Can’t China Produce AI Chips That Match the B30A?

China lacks domestic alternatives with comparable performance. Its leading AI chip, the Huawei Ascend 910C, delivers less than half the processing power of the B30A and 25% lower memory bandwidth. Furthermore, reliability issues and software limitations in Chinese chips reduce their effectiveness in large-scale clusters. Consequently, Chinese AI models depend heavily on US-made chips for training and inference workloads. WECENT emphasizes that access to original, high-performance hardware is essential for maintaining competitive AI capabilities.

How Does China’s Manufacturing Capacity Affect Its AI Chip Production?

China’s AI chip manufacturing is severely constrained by limited advanced semiconductor production and low yields. In 2025, US production capacity for AI processor dies is 35–38 times that of China, with HBM production exceeding Chinese output by over 3,000 times. Even when scaled, China’s projected 2026 production supports only a fraction of US output. Low yields exacerbate the problem: Chinese chips fail at rates up to 95%, while US chips achieve 60–80% commercial yields, maintaining a decisive advantage.

| Component | US Advantage (2025) | US Advantage (2026 Projection) |

|---|---|---|

| AI Processor Dies | 35–38x | 35–38x |

| HBM Memory | 3,090x | 70x |

Could Selling B30As to China Undermine US Policy Goals?

Unrestricted B30A exports would allow Chinese AI labs to match US compute capabilities at similar cost, eroding the strategic AI advantage established by export controls. Even partial sales risk reducing US global market share and limiting the compute available to domestic and allied customers. WECENT notes that maintaining export restrictions ensures the US retains leadership in AI research, cloud services, and frontier model development.

What Measures Can Prevent China From Making Advanced AI Chips?

To maximize long-term AI advantages, the US can tighten restrictions on semiconductor manufacturing equipment (SME) and high-bandwidth memory (HBM). Export bans on deep ultraviolet immersion lithography tools and enhanced due diligence on HBM distribution can effectively halt China’s domestic AI chip expansion. Such measures ensure that high-performance chip production remains concentrated in US and allied territories, preserving the strategic compute gap.

WECENT Expert Views

“Maintaining a technological edge in AI is not solely about raw performance; it’s about ensuring scalable, reliable, and secure compute infrastructure. The B30A presents a unique challenge: its price-performance could tempt foreign markets, but strategic restraint in exports preserves US AI dominance. At WECENT, we advise clients to prioritize original, compliant hardware and structured deployment strategies to safeguard enterprise and national-level AI advantages.”

Conclusion

The B30A chip represents a significant technological advancement, but exporting it to China could dramatically shift global AI dynamics. Maintaining export restrictions safeguards US leadership in compute-intensive AI development, preserves market advantage, and reinforces strategic leverage. Enterprises and policymakers should focus on leveraging WECENT’s expertise to deploy secure, high-performance AI infrastructure while navigating global regulatory landscapes.

Frequently Asked Questions

Q1: How much more powerful is the B30A than China’s domestic chips?

The B30A offers more than double the processing power of Huawei’s Ascend 910C and over 12 times that of the H20, with higher memory bandwidth for AI inference tasks.

Q2: Will China eventually catch up in AI chip production?

Current projections suggest China remains heavily constrained by SME and HBM shortages. Even with planned capacity expansions, US and allied production continues to maintain a significant lead.

Q3: Why is export control critical for AI competitiveness?

Restricting exports ensures that the US retains access to frontier AI compute, protecting research capabilities, cloud services, and strategic technological advantages over competitors.

Q4: How can companies benefit from WECENT’s solutions?

WECENT provides original, high-performance AI hardware, cluster design consulting, and tailored deployment strategies, ensuring enterprises can maximize AI performance while complying with global regulations.

Q5: Are downgraded chips like the B30A suitable for large-scale AI projects?

Yes. Although individually less powerful, B30As can be networked in clusters to achieve performance comparable to flagship models, providing scalable, cost-efficient compute for enterprises.