As financial data grows exponentially and transactions become instant, robust and high-performance server infrastructure is no longer optional—it’s essential. WECENT enables financial enterprises to deploy secure, powerful, and scalable systems that drive reliability, compliance, and speed in the digital economy.

How Is the Financial Industry Handling the Data Surge?

The financial industry faces explosive data growth. According to the International Data Corporation (IDC), global financial data volumes double every 12–18 months. With banking digitalization, high-frequency trading, real-time risk assessment, and fraud detection systems all running concurrently, data centers are under mounting pressure. In 2025, Deloitte reported that 72% of financial leaders cited “infrastructure scalability and latency” as their top IT pain points. Meanwhile, compliance standards like PCI DSS and ISO 27001 continue tightening, heightening the need for consistent, transparent hardware performance.

Financial institutions are also struggling with soaring costs. Gartner estimated a 28% year-over-year rise in server energy consumption across banking data centers due to inefficient legacy infrastructure. This inefficiency leads to slower transactions, higher operational expenses, and greater downtime risk.

What Are the Key Pain Points Facing Financial Institutions?

-

Latency and throughput constraints: Trading applications demand millisecond-level performance which outdated servers can’t deliver.

-

Security and regulatory demands: Data loss or delayed encryption processes can lead to heavy fines.

-

Scalability issues: Legacy infrastructure cannot efficiently handle spikes in demand during trading peaks.

-

Energy inefficiency: Aging server systems increase power consumption, affecting sustainability targets.

WECENT’s integrated approach helps financial firms address these challenges through advanced hardware configurations, optimized resource allocation, and end-to-end deployment support.

Why Are Traditional Financial IT Solutions Falling Behind?

Traditional financial servers often rely on outdated architectures with limited parallel processing capacity. These systems struggle to manage modern workloads involving machine learning, real-time analytics, and blockchain-based transactions. Maintenance cycles are lengthy, and downtime can directly impact service-level agreements (SLAs). Moreover, many vendors lack holistic support, forcing banks to coordinate multiple suppliers for hardware, networking, and software updates—leading to poor interoperability.

Conventional infrastructure also lacks the flexibility for cloud hybridization, a fast-emerging approach that blends on-premises control with cloud scalability. In contrast, WECENT’s updated server platforms enable seamless integration of cloud and edge computing environments for greater agility and cost-effectiveness.

What Makes WECENT’s Server Solution a Game-Changer?

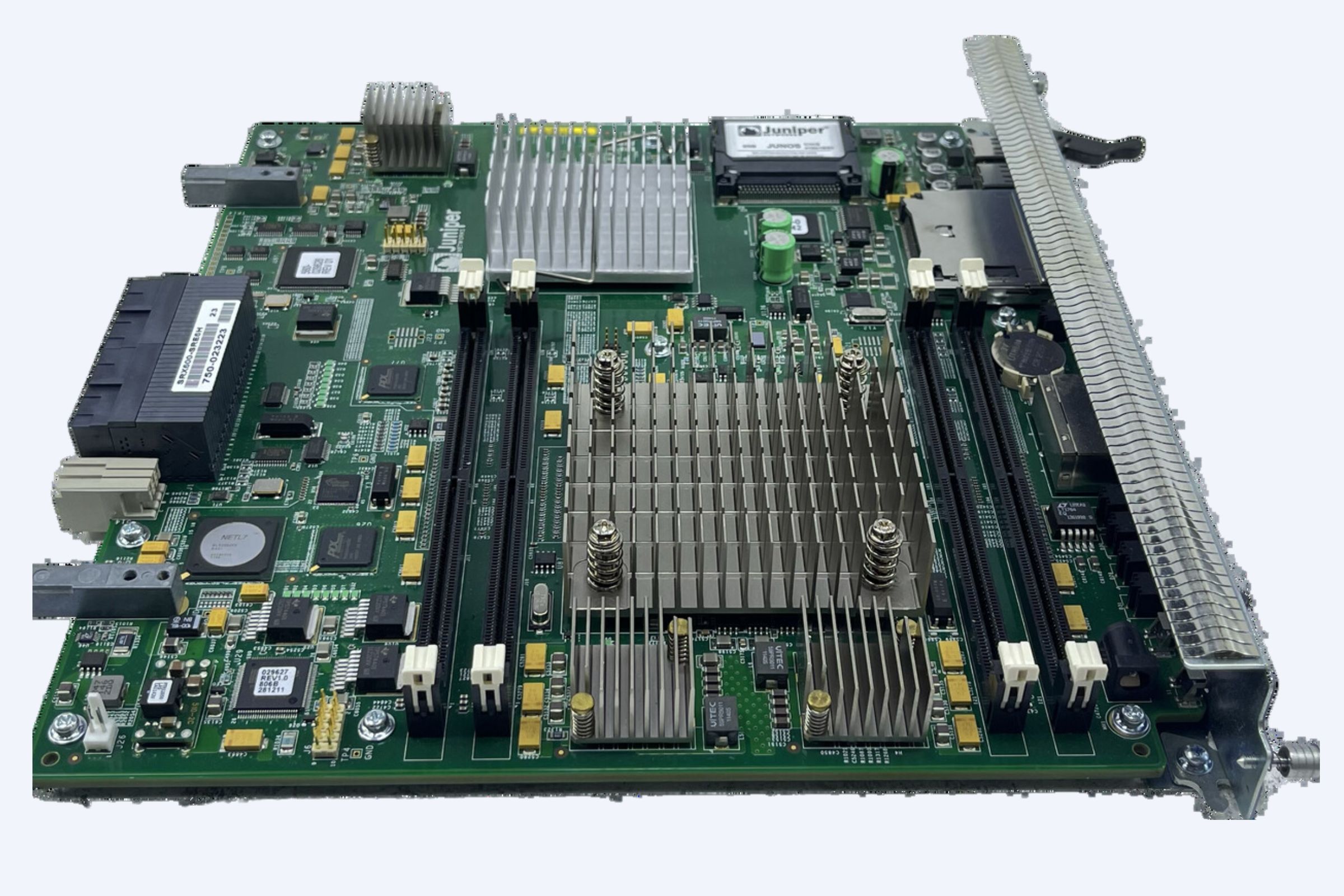

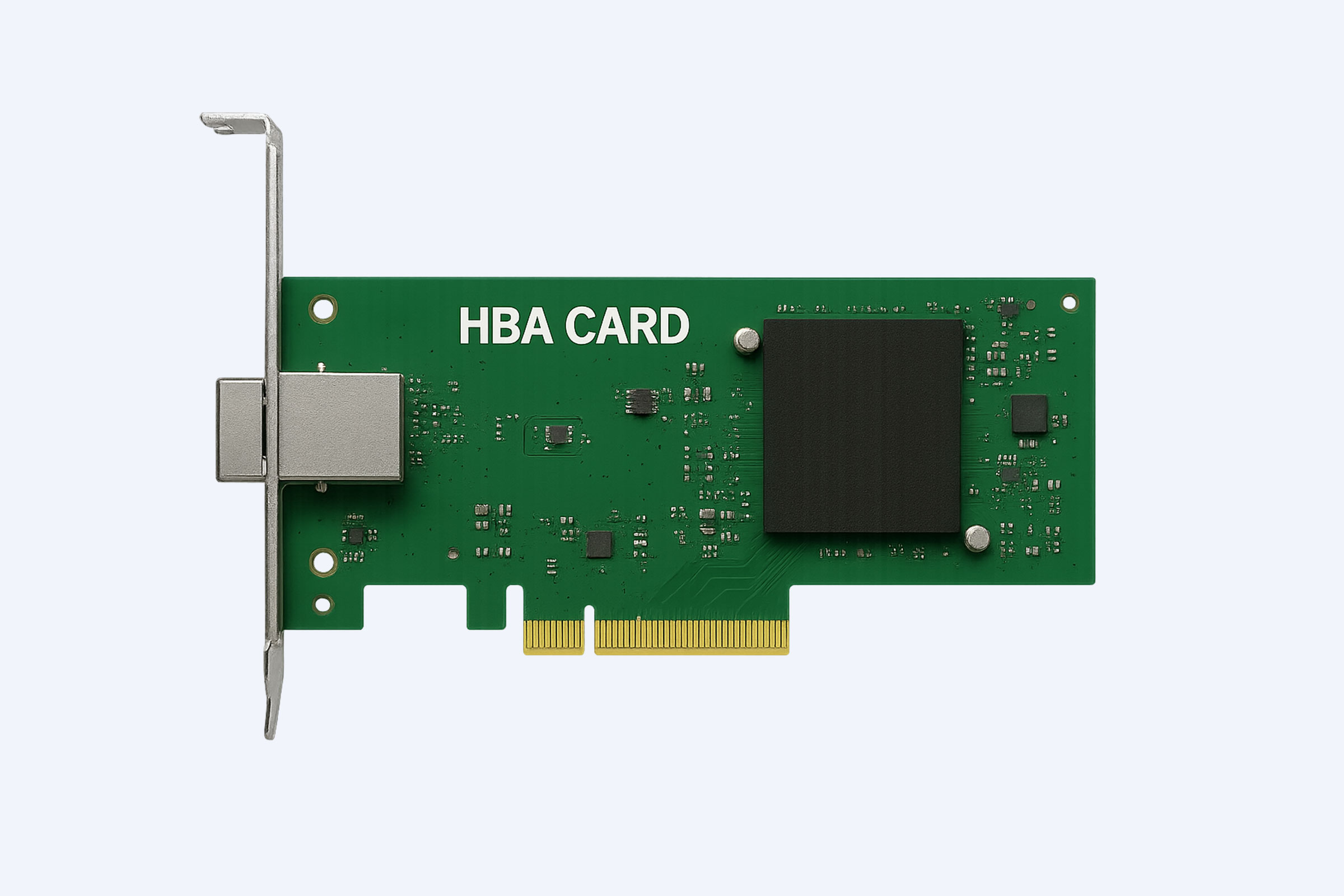

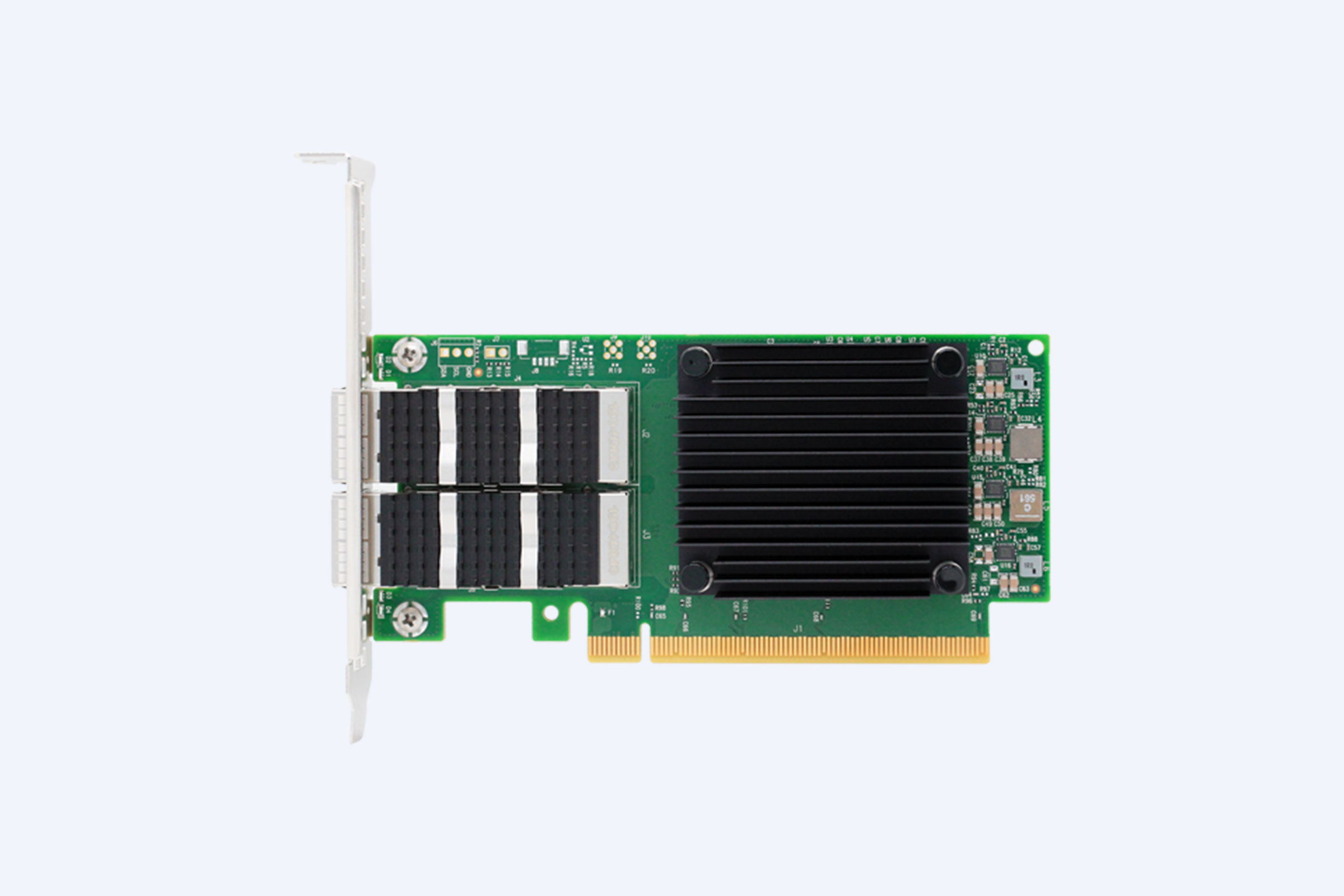

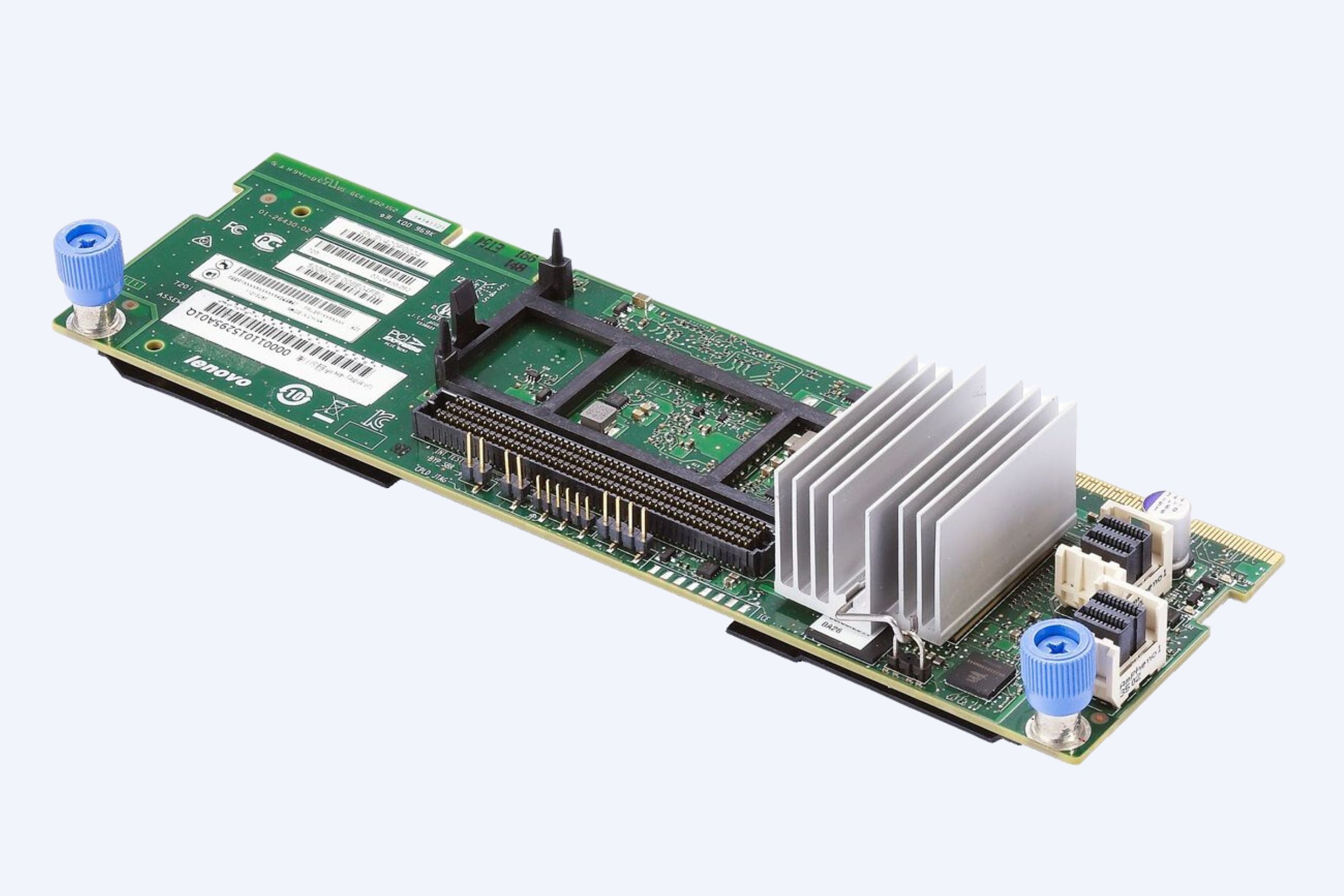

WECENT delivers financial-grade server solutions built to support critical workloads—ranging from high-frequency trading systems to AI-powered fraud detection. As an authorized supplier for Dell, Huawei, HP, Lenovo, Cisco, and H3C, WECENT provides guaranteed original components and manufacturer-backed reliability.

Core functions include:

-

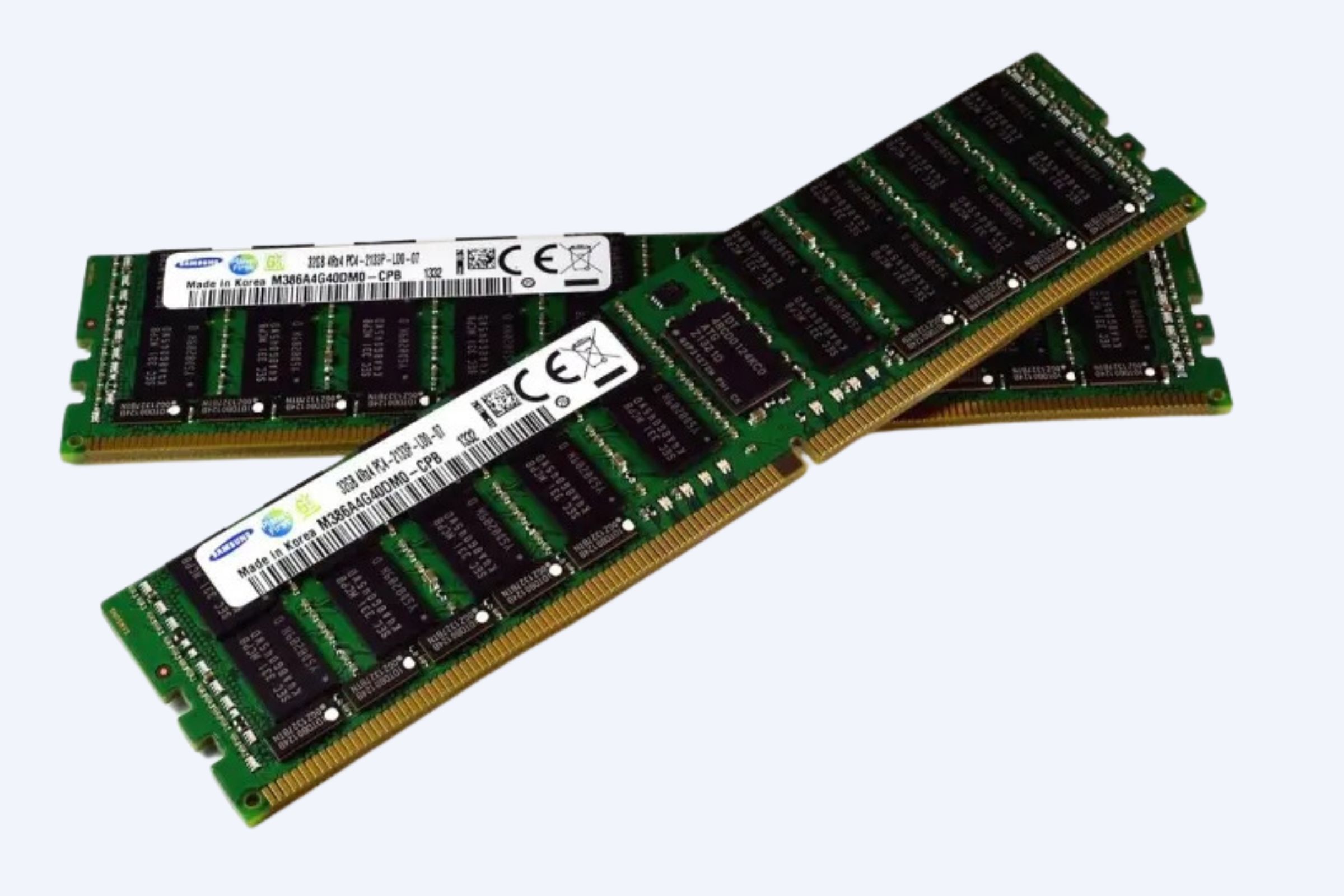

High-performance compute power: Featuring Intel Xeon scalable processors and NVIDIA data center GPUs (such as A100, H100, and RTX A6000) for rapid data processing.

-

Scalable storage architecture: Deployable PowerEdge and PowerVault systems ensure redundancy and consistent I/O speeds.

-

Comprehensive security: Embedded TPM 2.0 chips and firmware-level encryption safeguard sensitive data.

-

Lifecycle support: From consultation to installation, WECENT’s professional engineers provide round-the-clock technical guidance.

Which Advantages Differentiate WECENT from Traditional Systems?

| Feature | Traditional Infrastructure | WECENT Financial Server Solution |

|---|---|---|

| Processing Speed | Moderate (Single-threaded) | Extremely High (Multi-core GPU-assisted) |

| Data Security | Basic encryption | Hardware-level encryption and compliance-ready |

| Scalability | Manual expansion | Modular scalability |

| Energy Efficiency | High consumption | Low-power designs |

| Maintenance | Vendor-fragmented | Unified, ongoing support |

| Total Cost of Ownership | Rising annually | Optimized and predictable |

How Can Financial Institutions Deploy WECENT Solutions Step by Step?

-

Needs Assessment: WECENT’s consulting team evaluates workload requirements, compliance rules, and performance goals.

-

Product Selection: Based on business size and objectives, WECENT recommends optimal configurations—such as Dell PowerEdge R760, HPE ProLiant DL380 Gen11, or Cisco UCS series.

-

Configuration & Installation: Technicians handle racking, cabling, and tuning for maximum throughput.

-

Performance Testing: Systems undergo benchmarking to ensure compliance with financial SLAs.

-

Ongoing Maintenance: Continuous monitoring and firmware updates keep operations stable and secure.

Who Benefits Most from WECENT’s Financial Server Infrastructure?

Case 1: Core Banking Platform Upgrade

-

Problem: Legacy storage bottlenecks slowed transaction updates.

-

Traditional Method: Manual database partitioning.

-

Result After WECENT: Server response times decreased by 48%; uptime improved to 99.99%.

-

Key Benefit: Automated scaling supports customer growth seamlessly.

Case 2: AI Fraud Detection Deployment

-

Problem: Machine learning workloads overwhelmed compute nodes.

-

Traditional Method: Cloud outsourcing created latency concerns.

-

Result After WECENT: NVIDIA H100 GPU servers accelerated fraud detection by 3.2×.

-

Key Benefit: Local high-speed inference reduced false positives by 41%.

Case 3: Investment Analytics

-

Problem: Real-time data feeds lagged during trading peaks.

-

Traditional Method: Static compute clusters.

-

Result After WECENT: Dynamic load balancing improved query speed by 55%.

-

Key Benefit: Enhanced decision-making under volatile market conditions.

Case 4: Regulatory Reporting Automation

-

Problem: Data aggregation was error-prone and slow.

-

Traditional Method: Manual ETL tools.

-

Result After WECENT: Automated reporting pipelines cut compliance time from 6 hours to 1 hour.

-

Key Benefit: Reduced operational overhead while ensuring audit readiness.

Why Must Financial Firms Act Now?

The financial industry is entering a phase of accelerated AI adoption, distributed ledger technology (DLT), and quantum-resilient security models. Institutions that fail to modernize risk losing competitiveness as latency, cost, and compliance pressures mount. WECENT’s next-generation servers deliver the foundation for this transition—high-performance, low-latency, and verified for security-critical environments. Investing today ensures banks remain agile, secure, and data-driven tomorrow.

FAQ

-

1. How is Next-Generation Server Infrastructure Revolutionizing Finance?

Next-generation server infrastructure improves financial institutions by offering scalability, security, and high performance. WECENT supplies top-tier servers that handle big data and provide high availability for critical operations. Explore how upgrading to modern server solutions can future-proof financial operations with better performance and faster processing times.2. What Does Modern Server Infrastructure Mean for Financial Institutions?

Modern server infrastructure for finance means advanced storage, faster processing, and improved data management. WECENT offers flexible server solutions, including cloud computing and AI capabilities, tailored to financial needs. Modern servers help institutions process transactions faster, enhance security, and support regulatory compliance.3. Why Are Cloud Servers Crucial for the Financial Sector?

Cloud servers offer cost-effective, scalable, and secure solutions for financial institutions. WECENT’s cloud infrastructure helps financial organizations reduce operational costs, improve business continuity, and ensure data security. Cloud technology enables remote access, disaster recovery, and real-time data processing, making it essential for modern finance.4. How is Server Virtualization Changing the Banking Sector?

Server virtualization allows banks to optimize their infrastructure by consolidating resources, enhancing operational efficiency, and improving cost management. WECENT’s virtualization solutions offer flexibility, allowing banks to scale their operations with minimal downtime. This transformation helps reduce overhead while increasing system reliability and availability.5. How is High-Performance Computing Powering Financial Innovations?

High-performance computing (HPC) accelerates complex computations in finance, such as risk analysis and real-time data processing. WECENT provides powerful HPC servers, including NVIDIA GPUs, which allow for faster data handling and superior performance in tasks like algorithmic trading and big data analytics.6. Is It Time for Financial Institutions to Upgrade Their Servers?

Upgrading servers ensures optimal performance, security, and compliance with evolving financial regulations. WECENT specializes in offering tailored solutions for financial institutions. If your servers are outdated or no longer support growth, upgrading is crucial to improving efficiency and handling increasing transaction volumes and data loads.7. How Can Financial Institutions Ensure Data Security with Advanced Server Solutions?

Advanced server solutions provide encrypted storage, network security, and backup systems. WECENT’s secure server options incorporate firewalls, access controls, and redundant systems to protect sensitive financial data. With a focus on compliance and risk management, these solutions help meet regulatory requirements and safeguard client data.8. What is Serverless Architecture and How Is It Impacting Finance?

Serverless architecture helps financial institutions eliminate server management overhead by relying on cloud services to scale applications. This results in cost savings, increased flexibility, and faster deployment. WECENT’s serverless solutions for finance enable businesses to focus on core activities while reducing operational complexity and enhancing performance.