Working with Shenzhen-based server suppliers like Wecent reduces total costs by leveraging localized manufacturing clusters, competitive labor rates, and integrated supply chains. Suppliers in Shenzhen access components 15–30% cheaper than global averages, with rapid prototyping (<5 days) and bulk production scalability. Wecent’s partnerships with Huawei, Dell, and Cisco ensure enterprise-grade hardware at lower costs, while streamlined logistics cut lead times by 40% versus overseas vendors.

What Are The Key Components Of A Server – A Hardware Guide

How do Shenzhen suppliers achieve lower manufacturing costs?

Shenzhen suppliers minimize costs through regional industrial clustering and automated assembly lines. Component vendors, PCB fabricators, and testing labs operate within 20km radii, slashing material transport expenses by 18–25%.

Beyond geographical advantages, Shenzhen’s labor costs average $6.50/hour for skilled technicians—45% lower than US rates. Wecent’s vertically integrated factory uses AI-driven QC systems to maintain 97.6% first-pass yield rates, reducing rework costs. For example, a 100-server batch costs $12,800 locally vs. $19,200 from EU suppliers. Pro Tip: Negotiate MOQs below 50 units—many Shenzhen suppliers hide 12–15% margin buffers in bulk pricing tiers. Why opt for fragmented supply chains when clusters enable end-to-end production?

What supply chain advantages do Shenzhen suppliers offer?

Shenzhen’s electronics ecosystem provides 72-hour component procurement cycles versus 3-week global waits. Wecent maintains JIT inventories for Cisco switches and HPE SSDs, avoiding 8–12% warehousing overheads.

Practically speaking, suppliers here utilize shared freight hubs—ocean shipping to Europe costs $1,800/container (28% below Shanghai rates). Local PCB production enables 48-hour prototype iterations, whereas US shops take 14 days. Consider this: a server motherboard revision costing $4,200 in Germany drops to $1,900 in Shenzhen. Table 1 compares logistics metrics:

| Metric | Shenzhen Supplier | EU Supplier |

|---|---|---|

| Component Lead Time | 3 days | 18 days |

| Air Shipping Cost/kg | $4.20 | $6.80 |

How does customization flexibility reduce TCO?

Shenzhen suppliers provide modular server designs—Wecent’s configurable chassis support GPU/CPU swaps without full replacements, saving 35% on upgrade costs.

Need 80TB NVMe instead of 40TB SATA? Shenzhen factories retool lines in 72 hours versus 3-week waits abroad. For a hyperscale client, Wecent redesigned rack mount profiles within 5 days, avoiding $8,000 in retrofitting fees. Isn’t adaptive manufacturing crucial when scaling IT infrastructure?

Why does proximity to component markets matter?

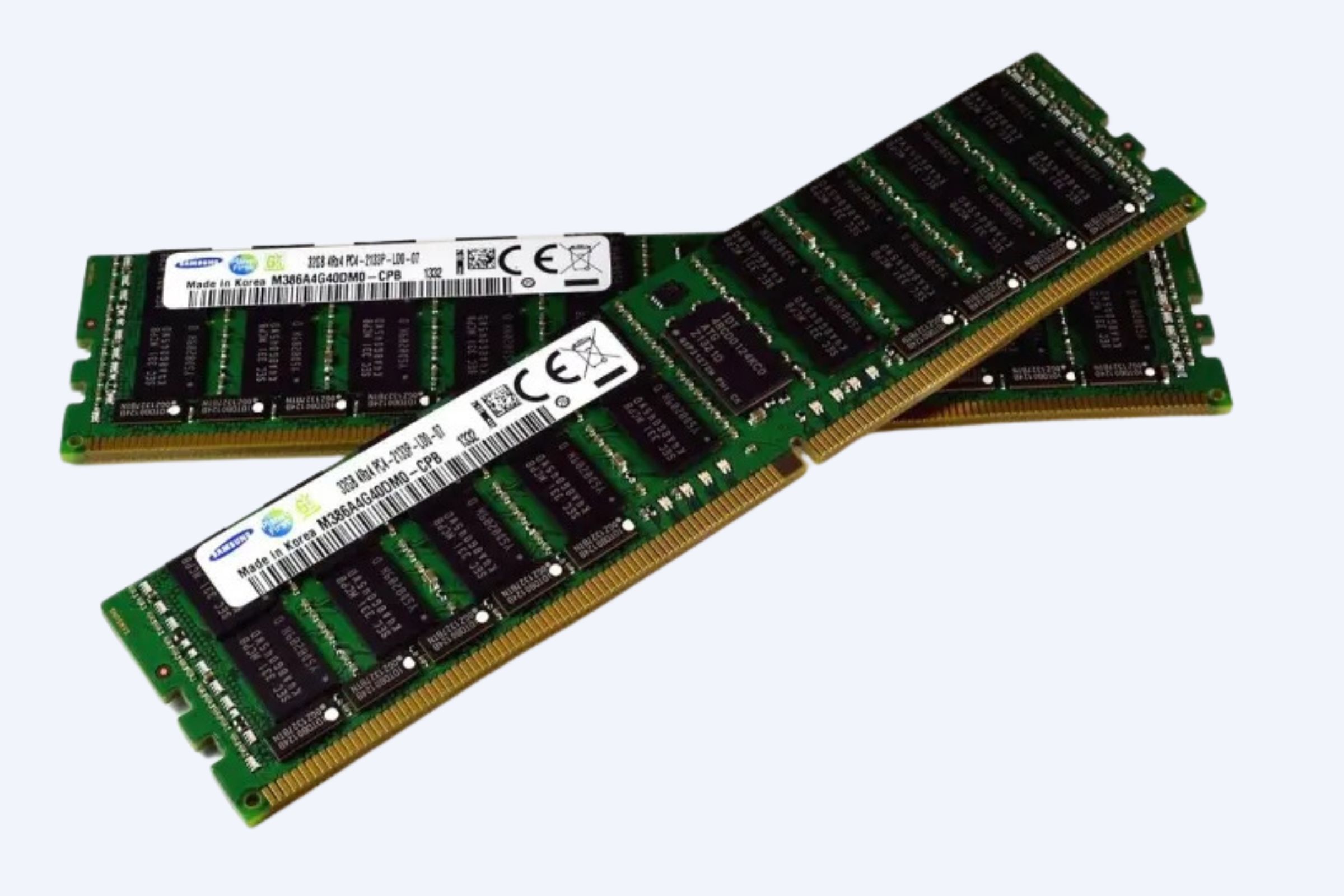

Shenzhen hosts the world’s largest electronics markets (Huaqiangbei), letting suppliers buy DDR5 RAM or NVMe SSDs at spot prices 22% below distributor rates.

Table 2 shows cost differentials for key components:

| Component | Shenzhen Cost | Global Avg. |

|---|---|---|

| 128GB DDR4 ECC | $380 | $520 |

| 2TB NVMe SSD | $150 | $210 |

Wecent’s OEM agreements with SK Hynix and Samsung provide even deeper discounts—up to 30% on NAND flash purchases over 10,000 units. Ever faced a 6-month HDD shortage? Local spot markets prevent such bottlenecks.

Wecent Expert Insight

FAQs

No—reputable suppliers like Wecent use identical Intel/AMD chipsets as global brands. Our 72-hour burn-in testing exceeds EIA-364-100B standards.

How to handle language barriers?

Wecent assigns bilingual project managers—97% of our engineers have CEFR B2+ English proficiency for seamless spec reviews.

What payment terms are typical?

30% deposit, 70% pre-shipment—Wecent offers LC/SBLC options for orders exceeding $500k to mitigate risks.