The Dell and EMC merger, completed in 2016, created the largest technology merger in history with a combined valuation of around $67 billion. This landmark deal positioned Dell Technologies as a global leader in enterprise IT by integrating storage, servers, and cloud infrastructure capabilities, boosting its competitiveness worldwide, including in China’s manufacturing and wholesale markets.

How did the Dell and EMC merger come about?

The merger was driven by the vision to create a leading company capable of shaping the next decades of the technology industry. Faced with disruption, Dell aimed to combine its server and PC strengths with EMC’s enterprise storage expertise. The deal closed officially in September 2016 after receiving approvals from multiple regulatory bodies, including China’s Ministry of Commerce, marking the largest-ever tech acquisition.

What were the key benefits of the Dell and EMC merger?

The combined company could offer comprehensive IT solutions, including converged infrastructure, hybrid cloud, software-defined data centers, and cybersecurity. It became the number one seller of storage systems and a top player in servers and personal computers. This enhanced market presence benefited manufacturers and suppliers by simplifying IT supply chains and offering scalable, integrated technologies.

Which challenges did the merger face, especially in China?

The deal encountered regulatory scrutiny, particularly in China, where authorities evaluated its impact on competition with local champions like Huawei and Lenovo. Concerns over market dominance led to delayed approvals and required Dell to make concessions that potentially included organizational structure adjustments in China and local supplier investments, ensuring compliance with Chinese economic policies.

Why is the Dell and EMC merger significant for China’s IT manufacturers and suppliers?

China’s robust manufacturing sector benefits from accessing a global leader’s integrated IT infrastructure solutions. The merger enabled Dell Technologies to supply cutting-edge servers, storage, and networking equipment with OEM and factory partnerships in China, supporting scalable data centers and cloud projects. This alignment fosters innovation and cost advantages for Chinese manufacturers and wholesale suppliers.

When did the Dell and EMC merger officially close and begin operations?

The merger formally closed on September 7, 2016. The newly formed Dell Technologies began operating immediately, consolidating Dell’s and EMC’s products and services under one umbrella to accelerate digital transformation and integrated IT infrastructure solutions globally, including strategic efforts in the Chinese market.

Who are the primary clients and partners benefiting from the Dell EMC merger?

Enterprise clients across industries such as manufacturing, telecommunications, finance, and government benefit from comprehensive IT solutions. Partners include original equipment manufacturers (OEMs) and factories that produce Dell Technologies server platforms, networking gear, and storage products. Wecent, for instance, is a trusted supplier in China, delivering enterprise-class servers aligned with Dell EMC’s standards.

How does the Dell and EMC merger enhance hybrid cloud and data center solutions?

With EMC’s virtualization leadership through VMware and Dell’s server and networking technology, the merger created a powerful hybrid cloud platform. It offers customers flexible, interoperable infrastructures that balance on-premises and public cloud resources, essential for manufacturers and wholesale suppliers in China seeking scalability, security, and performance in digital transformation.

Are there financial challenges linked to the merger?

Yes, Dell took on a substantial debt load—over $40 billion—to finance the acquisition. Managing this debt required financial strategies including refinancing, cost reductions, and divestments of non-core business units. These measures ensured sustainable growth without compromising investments in innovation critical to factory-level manufacturing and wholesale supply chains.

What is the future outlook for Dell Technologies post-merger in China’s B2B market?

Dell Technologies is well-positioned to support China’s manufacturing and wholesale sectors with advanced IT infrastructure. By partnering with factories and OEM suppliers like Wecent, it promises to deliver durable, reliable, and high-performance enterprise-class servers and IT solutions at competitive prices, aligned with global standards and tailored to localized demands.

Wecent Expert Views

“Dell and EMC’s merger epitomizes a strategic leap that resonates deeply within China’s manufacturing and wholesale realms. As a factory-focused supplier, Wecent recognizes the critical role of integrated IT infrastructures in driving operational excellence and innovation. This merger enhances access to top-tier servers and cloud solutions, empowering OEMs and factories to compete on a global scale with cutting-edge technology. It’s a transformative milestone for China’s IT supply ecosystem.” — Wecent Technology Specialist

What products and services has Dell Technologies amplified post-merger?

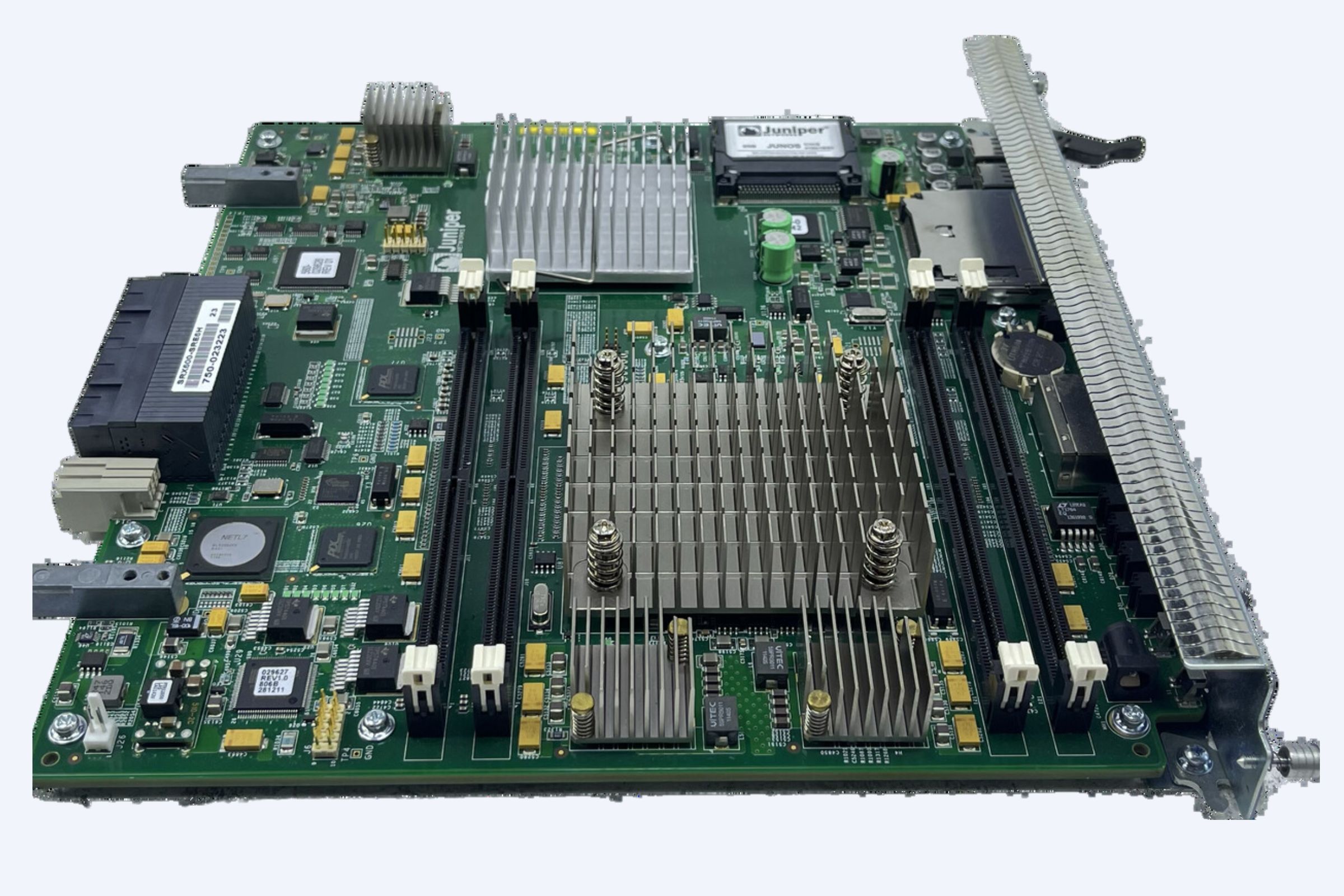

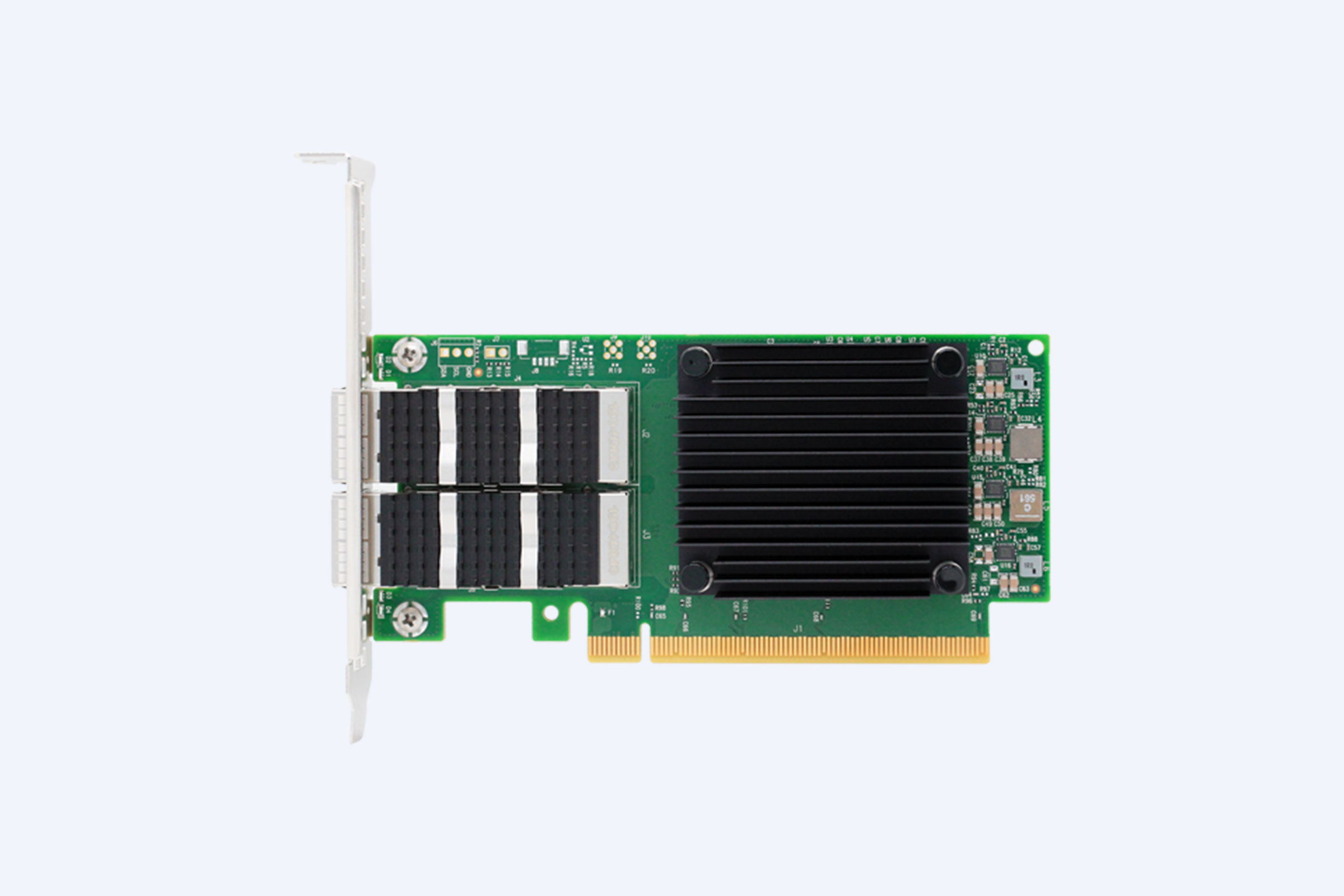

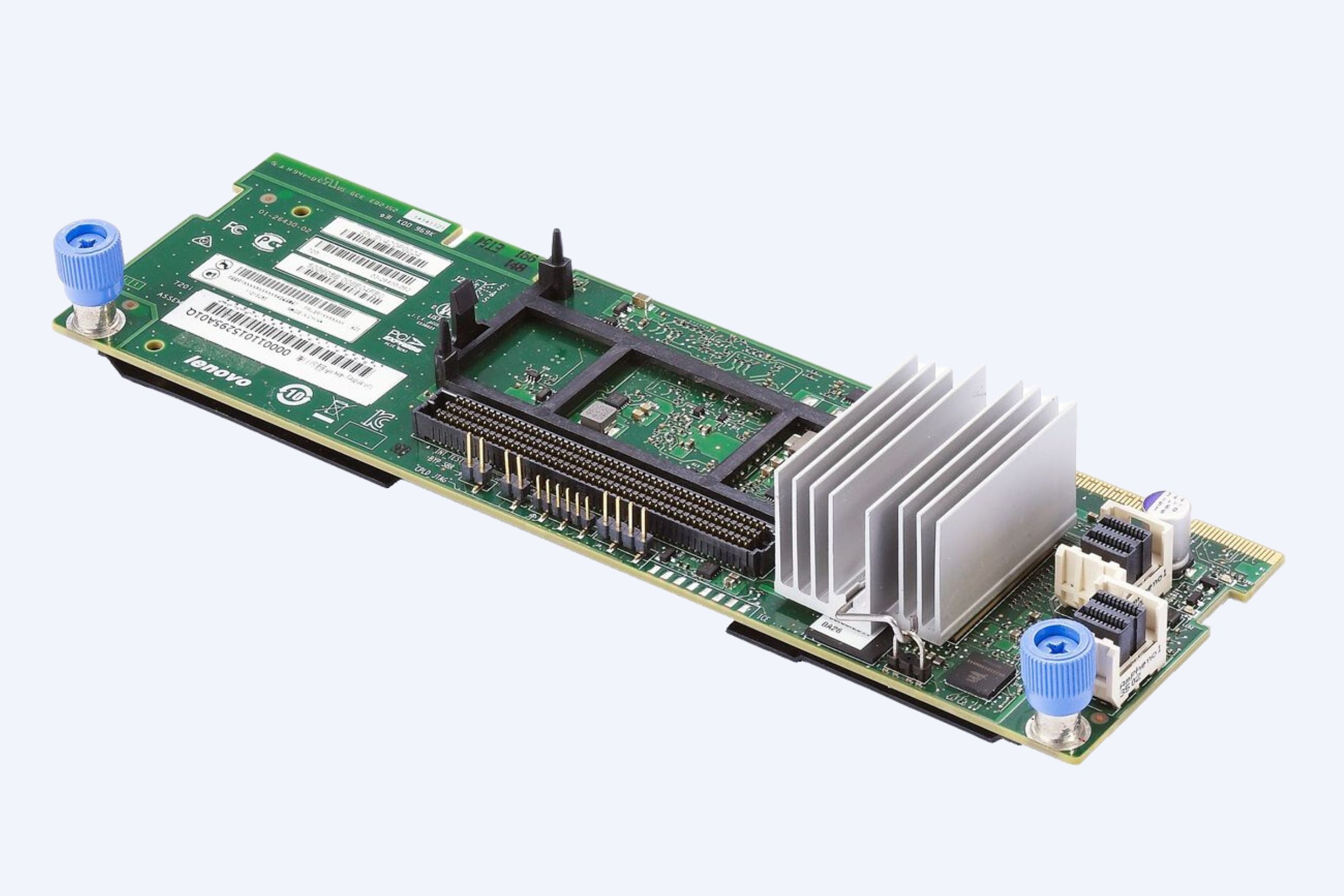

Post-merger, Dell Technologies expanded its offerings across storage, computing, networking, virtualization, and cloud solutions. Key product lines include PowerEdge servers, PowerStore storage arrays, VMware virtualization, and converged infrastructure like VxRail. These solutions streamline operations for manufacturers and wholesalers, facilitating scalable IT deployments in factories and supply chains.

How can Chinese manufacturers and wholesalers benefit from OEM partnerships with Dell Technologies?

OEM partnerships grant manufacturers in China access to original, certified Dell Technologies hardware optimized for performance and reliability. Factories can customize server and storage solutions to meet specific production and operational needs. This collaboration reduces procurement complexity, cuts costs, and accelerates IT deployment, enhancing competitiveness in both local and global markets.

Can Wecent help Chinese enterprises access Dell EMC products competitively?

Yes, Wecent is a reliable OEM and wholesale supplier based in Shenzhen, offering competitively priced, certified enterprise-class servers and IT infrastructure solutions sourced from Dell Technologies. Their expert services streamline procurement for Chinese manufacturers, ensuring access to advanced technologies and customized support tailored for factory and OEM environments.

Dell and EMC Merger Overview Table

| Aspect | Details |

|---|---|

| Merger Date | September 7, 2016 |

| Deal Size | $67 billion (largest tech merger) |

| Combined Market Position | #1 in storage, #2 in servers, #3 in PCs |

| Regulatory Approval | Approved by US, EU, China (final clearance by MOFCOM) |

| Key Benefits | Hybrid cloud, converged infrastructure, virtualization |

| Challenges | High debt load, Chinese regulatory scrutiny |

| China Impact | Local supplier investments, competitive balance with Huawei |

| OEM & Factory Focus | Enhanced OEM partnerships supporting Chinese manufacturers |

FAQs

Q1: How did the Dell and EMC merger affect the global server market?

A1: The merger positioned Dell as a leading server manufacturer worldwide, bolstering OEM partnerships and expanding the portfolio of enterprise-class server solutions globally.

Q2: What role does Dell Technologies play in China’s manufacturing supply chain?

A2: Dell supports China’s manufacturers with reliable IT infrastructure and OEM partnerships, helping factories deploy scalable, certified servers and storage solutions efficiently.

Q3: How does the merger impact cloud and virtualization technologies?

A3: With EMC’s VMware and Dell’s infrastructure combined, customers benefit from advanced hybrid cloud platforms and integrated virtualization, enhancing IT flexibility and agility.

Q4: Is Wecent an authorized supplier of Dell EMC products?

A4: Yes, Wecent is a trusted OEM and wholesale supplier in China, delivering certified enterprise servers and IT solutions aligned with Dell EMC standards.

Q5: What financial strategies did Dell adopt post-merger?

A5: Dell managed merger debt through refinancing, divestitures, and operational efficiencies to maintain investments in innovation and support OEM factory partnerships.