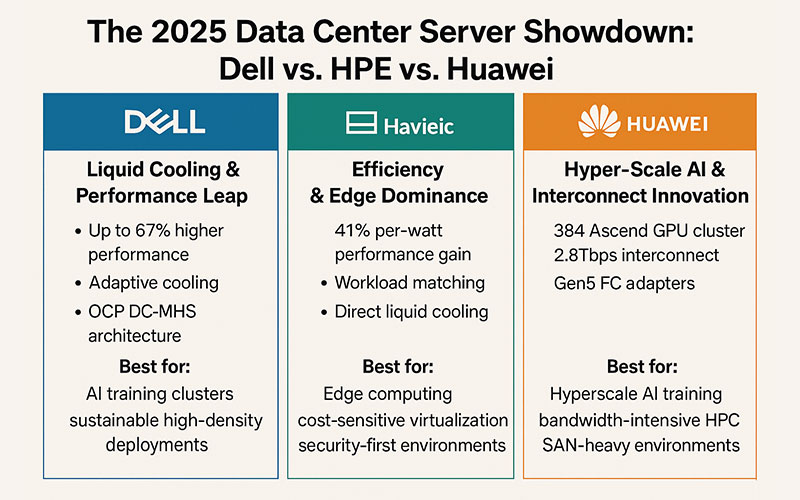

The 2025 Data Center Server Showdown: Dell vs. HPE vs. Huawei

The relentless surge of AI, hybrid cloud, and real-time analytics has transformed server selection from an infrastructure decision to a strategic business imperative. As we navigate 2025, Dell, HPE, and Huawei each offer distinct paths for data center modernization—but aligning their strengths with your workloads is critical. Here’s how to decode their offerings.

⚙️ The Core Battle Lines: Technology & Architecture

Dell PowerEdge: Liquid Cooling & Performance Leap

Dell’s latest PowerEdge servers (e.g., R770) leverage Intel Xeon 6 P-core processors to deliver up to 67% higher performance while slashing energy costs by 50%6. Their real ace? Adaptive cooling:

- Smart Cooling 2.0: AI-driven airflow optimization + multi-phase liquid cooling (cold plate/immersion), enabling PUE as low as 1.02 for new builds210.

- OCP DC-MHS Architecture: Modular design simplifies scaling for AI factories, supporting racks up to 480kW with near-zero thermal waste10.

Best for: AI training clusters, sustainable high-density deployments.

HPE ProLiant Gen12: Efficiency & Edge Dominance

HPE’s Gen12 servers, armed with Intel Xeon 6, achieve a 41% per-watt performance gain—replacing 7x Gen10 servers with one Gen12 unit37. Key innovations:

- Workload Matching: Auto-optimizes BIOS for specific apps (e.g., boosted virtualization by 321% in benchmarks)5.

- Direct Liquid Cooling (DLC): Optional for edge sites where space/power constraints exist3.

- Silicon-to-Software Security: Hardware-rooted trust chips block firmware attacks, critical for distributed edge networks5.

Best for: Edge computing, cost-sensitive virtualization, security-first environments.

Huawei: Hyper-Scale AI & Interconnect Innovation

Huawei targets the AI infrastructure race with its CloudMatrix 384 “super node”—384 Ascend GPUs in a single cluster, delivering 300 PFlops (67% higher than NVIDIA’s NVL72)8. Noteworthy advantages:

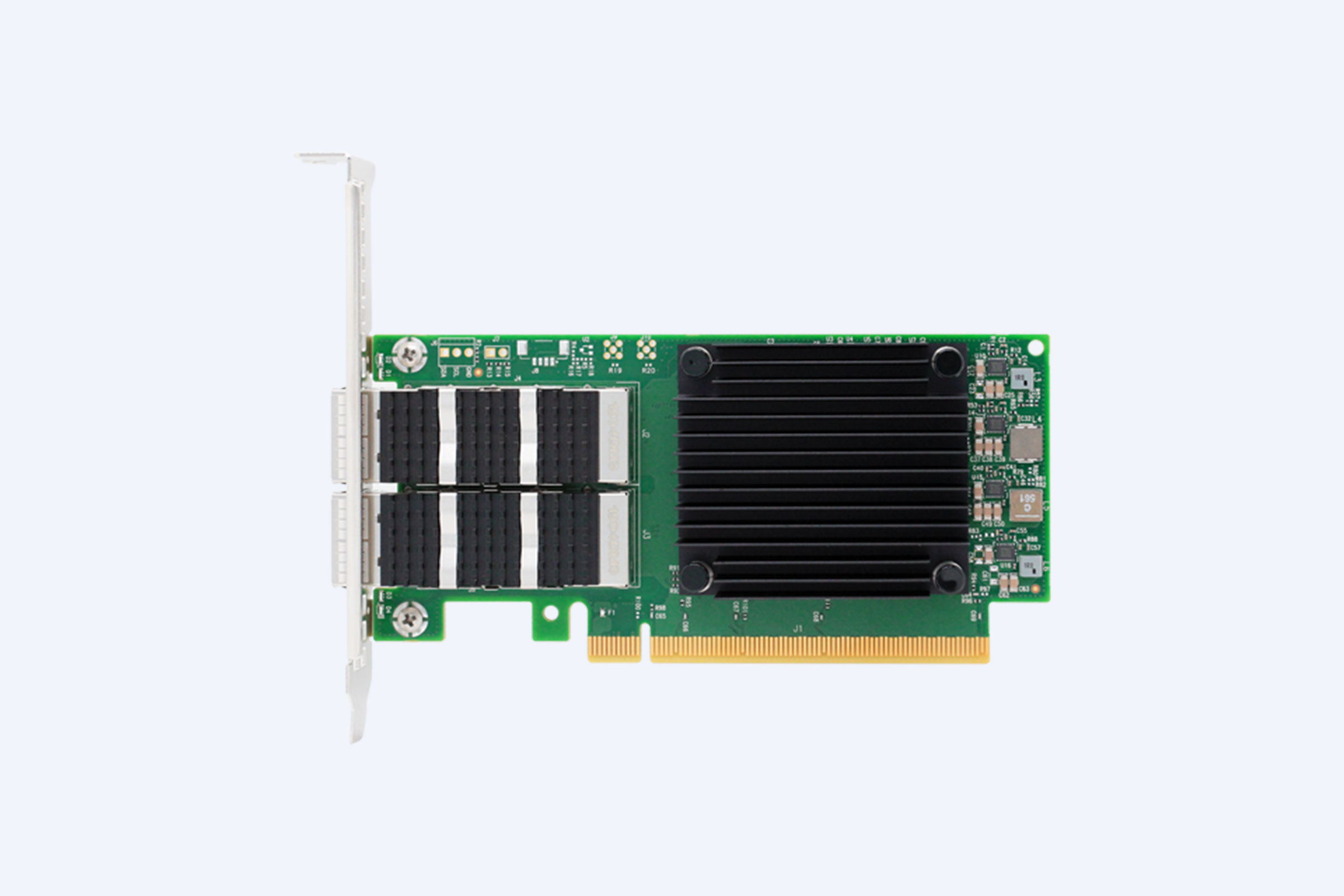

- 2.8Tbps Interconnect: 6,812x 400G optical modules enable near-instant GPU communication, slashing LLM training interruptions8.

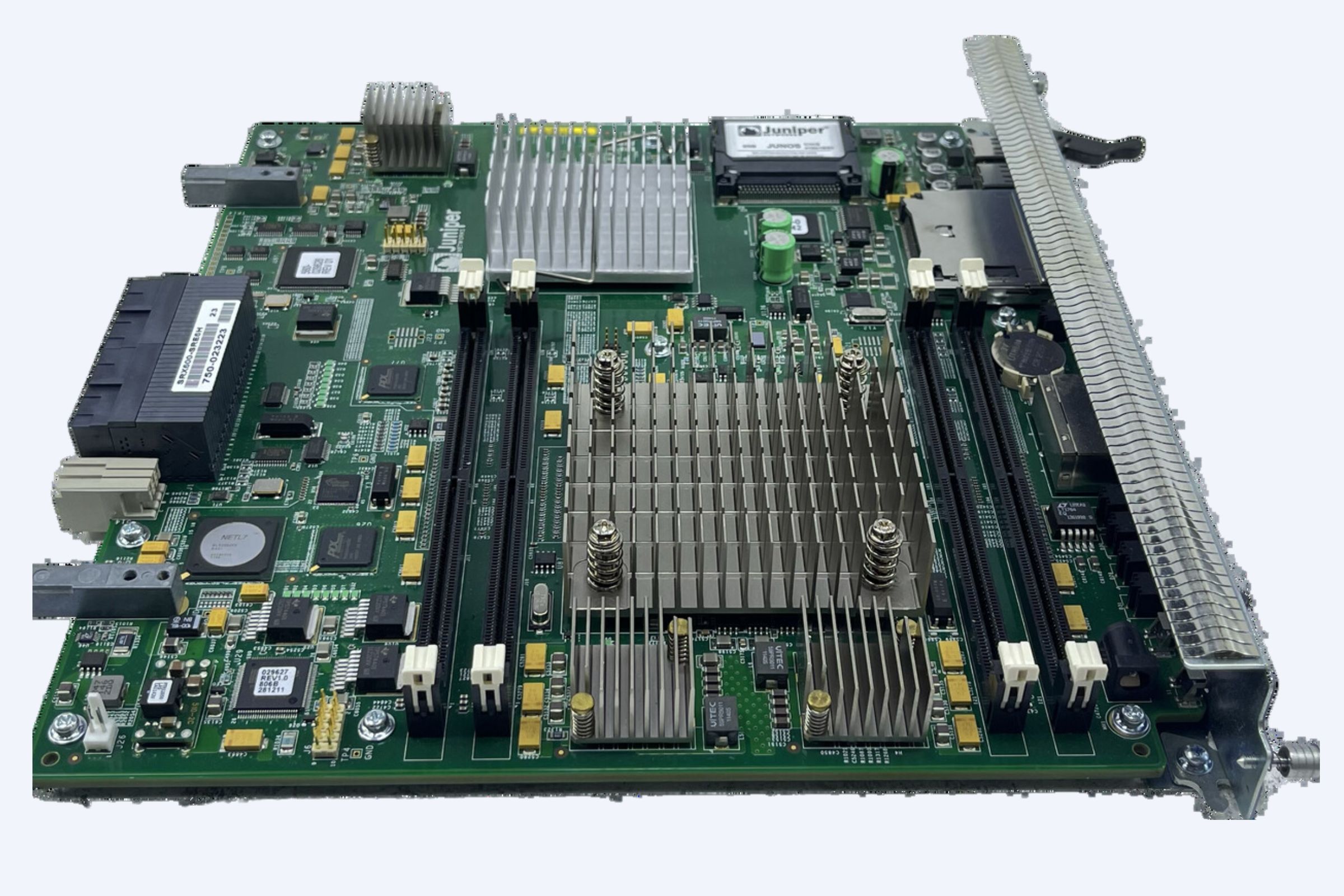

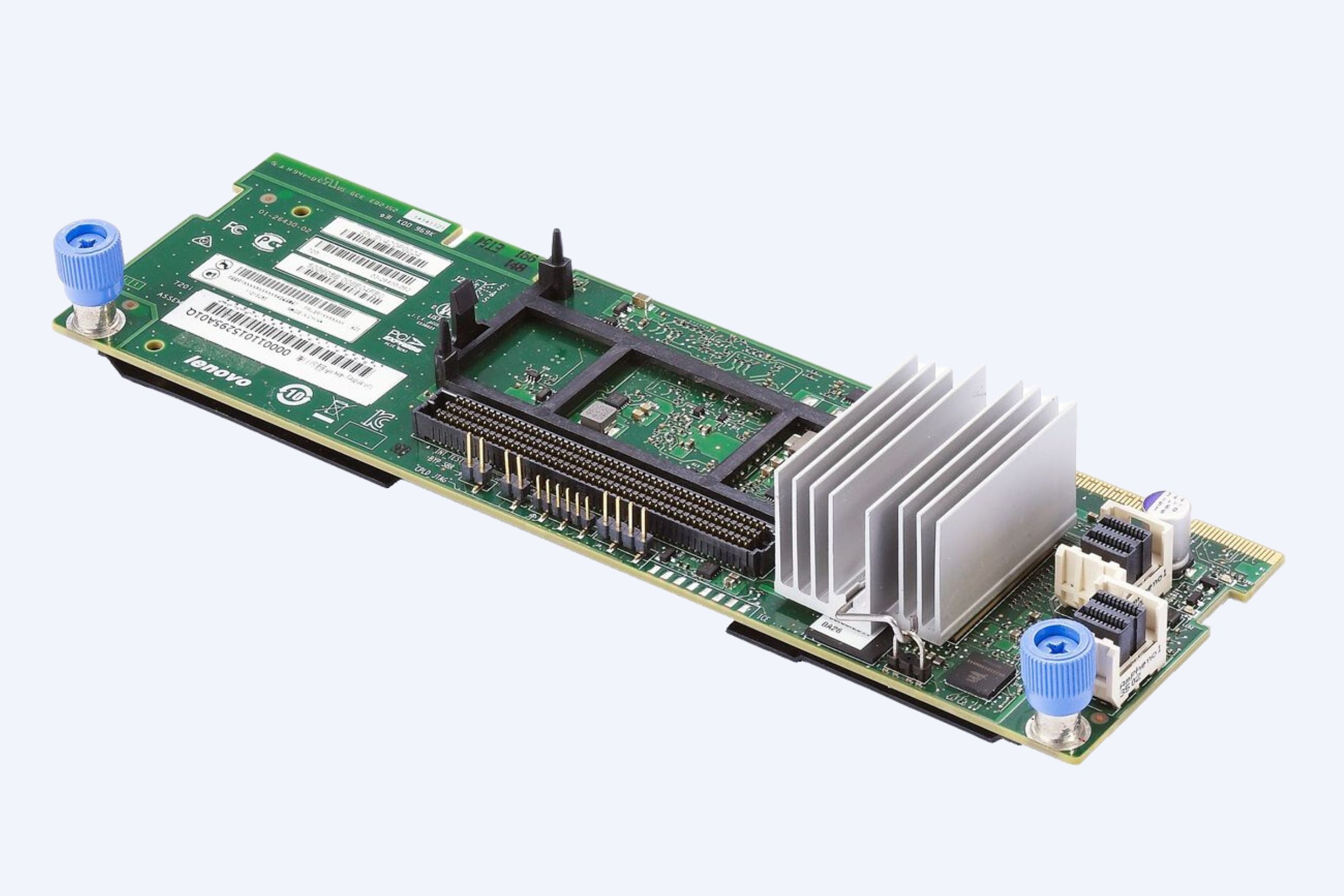

- Gen5 FC Adapters: Co-developed with QLogic, they triple I/O throughput vs. 8Gb Fibre Channel, ideal for real-time analytics4.

Best for: Hyperscale AI training, bandwidth-intensive HPC, SAN-heavy environments.

⚖️ Comparative Analysis: Breaking Down the Tradeoffs

able: Key Metrics for Strategic Server Selection (2025)

| Criteria | Dell PowerEdge | HPE ProLiant Gen12 | Huawei |

|---|---|---|---|

| Peak Compute Density | 24K-27K cores/rack (M7725) | ~40% fewer cores vs. Dell | 384 GPUs/super-node |

| Energy Efficiency | 50% lower TCO6 | 65% power saving3 | Higher watt/FLOP8 |

| Cooling Tech | Immersion-ready (PUE 1.02) | Air/DLC hybrid | Traditional air/liquid |

| Security | iDRAC 10 + Zero Trust | 360° firmware armor5 | Multi-port isolation |

| Ideal Workload | AI factories, green DCs | Edge, mid-market cloud | LLM training, massive data |

🎯 Matching Servers to Your Industry: Use Cases

- Financial Services: Huawei’s low-latency FC adapters accelerate risk modeling, while HPE’s security protects transaction systems45.

- Healthcare & Research: Dell’s liquid-cooled racks handle genomics simulations (e.g., TACC’s supercomputer)2, HPE’s DLC fits compact lab edges.

- Manufacturing/Edge AI: HPE Gen12’s compact form + workload automation suits factory-floor inference; Huawei’s CloudMatrix trains plant-wide models8.

- Public Cloud Providers: Dell’s OCP racks enable scalable AIaaS; Huawei’s super-nodes maximize GPU utilization for rentable inferencing10.

🔮 Future-Proofing Your Investment: 3 Strategic Shifts

- Liquid Cooling Mandatory: With CPU/GPU TDPs exceeding 1.4kW, Dell’s phased immersion and HPE’s DLC are essential for >40kW racks210.

- Disaggregated Composable Infrastructure: Dell’s IR7000 and Huawei’s CloudMatrix allow CPU/GPU/storage scaling—avoid monolithic lock-in810.

- AI-Optimized Silicon: Prioritize servers with NPUs (e.g., Xeon 6) for 2-4× inferencing gains over generic CPUs37.

💎 The Bottom Line: Your Decision Framework

- Choose Dell if: Sustainability, AI density, and liquid-cooled futures dominate your roadmap.

- Choose HPE if: Edge consolidation, workload flexibility, and unbreakable security are non-negotiable.

- Choose Huawei if: Building China/APAC-focused LLMs or needing petabyte-scale storage throughput.

Final Tip: Test iteratively! Pilot Dell’s PowerEdge for AI training, HPE Gen12 for branch sites, and Huawei for SAN-heavy apps. Hybrid infrastructure is now the norm—not the exception.

Data centers in 2025 demand servers that fuse raw power with architectural agility. Dell leads in sustainable high-performance, HPE in adaptive edge efficiency, and Huawei in brute-force AI scale. Your workload DNA decides the winner.

FAQs

Which server brand is best for AI and high-performance computing in 2025?

Dell PowerEdge servers are ideal for AI training and high-performance computing due to their balance of performance, energy efficiency, and extensive configuration options. They excel in single-threaded workloads and support liquid-cooling solutions, making them suitable for demanding enterprise AI and HPC deployments.

How does HPE ProLiant differ from Dell in enterprise data centers?

HPE ProLiant servers focus on edge efficiency, multi-threaded workloads, virtualization, and hybrid cloud integration via the GreenLake platform. They provide strong security features, modular expansion, and seamless integration, making them suitable for big data, branch sites, and complex virtualized environments.

Is Huawei suitable for global enterprise server deployments?

Huawei FusionServer excels in high-throughput AI and storage applications, especially in China and APAC regions. However, geopolitical restrictions and trade policies may limit its adoption in North America and Europe, making it a specialized choice for large-scale AI or SAN-focused workloads.

What factors should businesses consider when choosing a data center server?

Key considerations include workload requirements, integration with existing infrastructure, support and reliability, sustainability, and geopolitical factors. Proof-of-concept testing is recommended to evaluate performance. WECENT offers guidance and tailored enterprise solutions to help organizations select the optimal servers for AI, virtualization, and cloud workloads.

What makes the Dell PowerEdge R660 a standout rack server?

The Dell PowerEdge R660 delivers next-generation performance in a compact 1U form factor, supporting high-density computing and AI workloads. It features advanced management tools, energy-efficient design, and flexible configuration options, making it ideal for enterprise data centers seeking powerful yet space-saving server solutions.

How is the global server market expected to grow by 2031?

The global servers market is projected to reach USD 281.26 billion by 2031, driven by demand for AI, cloud computing, and data center expansion. Leading players include Dell, HPE, IBM, Lenovo, Cisco, Huawei, and NVIDIA, reflecting strong growth across enterprise IT infrastructure and high-performance computing segments.

What is the forecast for the AI server market by 2033?

The AI server market is expected to grow from USD 126.34 billion in 2024 to USD 1.84 trillion by 2033, with a CAGR of 34.73%. Growth is fueled by AI adoption in enterprise, cloud, and HPC environments, requiring specialized servers from brands like Dell, IBM, HPE, Huawei, and NVIDIA.

Which companies lead in AI-optimized servers and data center solutions in 2025?

Dell, HPE, and Lenovo lead in AI-optimized servers, offering hybrid cloud integration, strategic acquisitions, and high-performance solutions. Their servers support AI workloads, virtualization, and data center scalability. WECENT supplies these enterprise-grade solutions with full support for deployment, configuration, and maintenance.

How do I choose between Dell, HPE, and Huawei servers for my data center in 2025?

Choosing the right server depends on your specific needs: Dell excels in AI and high-performance environments, HPE offers superior edge computing and security, while Huawei is ideal for large-scale AI and storage, especially in the APAC region. Assess your workload, scalability, and security priorities before deciding.

Which server brand is best for AI-intensive workloads in 2025?

Dell’s PowerEdge servers are leading in AI-intensive workloads due to their high-performance capabilities, scalability, and sustainability features. They are particularly suited for demanding AI models and high-density environments, making them an excellent choice for enterprises focused on AI.

What are the security features of HPE servers?

HPE’s ProLiant servers are known for their robust, enterprise-grade security features. Their focus on “unbreakable” security makes them ideal for sensitive environments, with advanced encryption, data protection, and compliance tools tailored to edge and hybrid cloud deployments.

Why should I consider Huawei for large-scale storage needs?

Huawei’s FusionServer and Atlas solutions offer immense storage throughput, making them an ideal choice for large-scale storage and AI applications. Their specialized non-x86 architectures and NPU cards are optimized for petabyte-scale storage and demanding AI workloads, particularly in the APAC market.

What is the projected growth of the AI server market by 2033?

The AI server market is expected to grow significantly, reaching USD 1.84 trillion by 2033 from USD 126.34 billion in 2024. This growth is driven by a compound annual growth rate (CAGR) of 34.73%, reflecting the increasing demand for AI-driven infrastructure across various industries.

What is driving the adoption of containerized data centers?

Containerized data centers offer benefits like rapid deployment, modular scalability, and efficient integration with edge computing. These factors are making them increasingly popular among businesses looking for flexible, cost-effective IT solutions, which is fueling growth in this market between 2025 and 2030.

Why are 21-inch open rack enclosures gaining traction in AI data centers?

By 2030, 21-inch Open Rack enclosures are projected to dominate AI data center shipments. These racks offer better cooling, power efficiency, and scalability for AI workloads, addressing the increasing demands of high-density compute environments, especially in hyperscale data centers.

How are liquid cooling solutions impacting server performance?

JetCool’s SmartPlate liquid cooling, used in Dell PowerEdge servers, improves heat dissipation for high-density AI and HPC workloads. Liquid cooling technology is becoming essential in managing the thermal demands of modern servers, boosting efficiency and longevity of IT infrastructure.